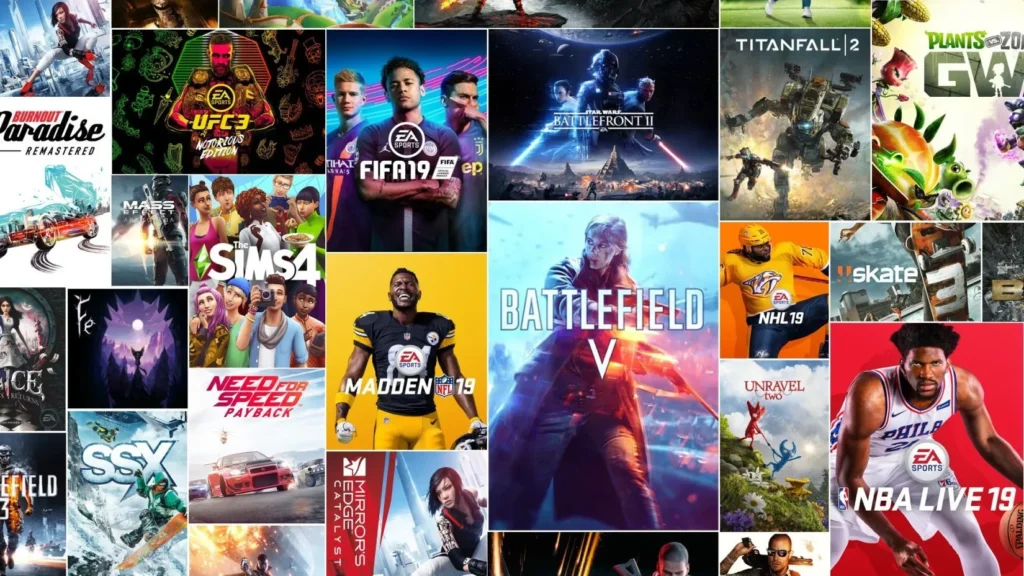

Electronic Arts (EA), the powerhouse behind Battlefield, Madden NFL, The Sims, and many more, is embarking on one of the largest transformations in gaming industry history. On September 29, 2025, EA’s Board approved a deal to take the company private in a $55 billion leveraged buyout, led by a consortium including Saudi Arabia’s Public Investment Fund (PIF), Silver Lake, and Affinity Partners. The transaction, subject to regulatory and shareholder approvals, is expected to close in the first quarter of EA’s fiscal year 2027.

What exactly is the deal?

Buyout Value & Parties Involved: Electronic Arts stockholders will receive $210 per share in cash, representing a ~25% premium to EA’s share price before the deal was made public. The consortium includes PIF (which already owns ~9.9% of EA), Silver Lake, and Affinity Partners.

Financing Structure: The deal is being financed with about $36 billion in equity (including PIF rolling over its existing stake) plus $20 billion in debt funding, largely backed by JPMorgan Chase. Approximately $18 billion is expected to be provided at closing.

Timeline & Outcome: Once completed, EA will cease to be a publicly traded company, delisting from stock markets. CEO Andrew Wilson is expected to stay in his role, and the company headquarters will remain in Redwood City, California.

Page content

Wht this changes the game?

1. Greater flexibility & long-term strategy

Being private means Electronic Arts won’t face the same public-market pressures to hit quarterly earnings, which often push big publishers toward safe bets like live service titles, microtransactions, or annual sports franchises. Without needing to constantly justify performance to shareholders, EA may have more room to greenlight experimental projects, invest in new IPs, or take risks that earn returns only in the long term.

2. Debt load & financial pressure

That $20 billion of debt financing isn’t trivial. After the deal closes, servicing the debt (interest payments, etc.) will become a substantial part of EA’s cost structure. Analysts warn this could force tightness in budgets, possible consolidation of teams or studios, or even layoffs. So the freedom it gains via private ownership isn’t entirely without strings.

3. Potential impacts on game design & monetization

With fewer eyes from public investors, EA may shift or experiment with how it monetizes its games. Live services, in-game purchases, subscription models, or even leveraging AI to reduce costs (asset creation, QA, etc.) might be more aggressively pursued. But there’s also concern among gamers that transparency and accountability could decline.

4. Investor influence & global Strategy

PIF’s involvement is especially noteworthy. Saudi Arabia has been investing heavily in the gaming and esports sectors in recent years as part of its economic diversification plans. This deal aligns with those ambitions. Through this buyout, EA’s strategic direction may more closely align with global ambitions of the investors—perhaps placing more emphasis on expanding in new regions, exploring media tie-ins, or ventures that bridge gaming, entertainment, and technology.

Risks & what gamers ghould watch out for

Studio Restructuring & Layoffs: As mentioned, the debt burden and desire for efficiency often lead to cost cuts after buyouts. Some studios or projects might be scaled back or cancelled.

Slower Transparency: Private companies don’t have to release earnings reports publicly. Gamers and watchdogs may find it harder to see how Electronic Arts is making decisions or how money is being spent.

Change in Priorities: The push for long-term projects is appealing, but private equity has its own return expectations. There’s risk that EA might double down on proven revenue streams, possibly at the cost of creative experiments or smaller indie-style titles

Final thoughts for Electronic Arts

EA’s decision to go private via this $55B deal could be a turning point—not just for the company, but for the gaming industry at large. The structure gives EA potential breathing room to innovate and take risks that public market pressures often discourage. But with that freedom comes responsibility: big debt, high expectations, and new ownership with its own agendas.

For gamers, this could mean richer stories, riskier and more ambitious titles, or maybe just more polished live-services. What matters is how EA manages the transition: will they lean into creator culture and experimental work, or double-down on familiar revenue engines? The next couple of years will be crucial.

Read more news with Savepoint to catch up industry updates and trends.